Accounting And Finance, UNIVERSITY 1st and 2nd Year (LEVELS 4 and 5)

ACCOUNTING AND FINANCE - EXTENDED DIPLOMA

UNIVERSITY 1st Year

LEVELS: 4 | CREDITS: 120 | £4999

ACCOUNTING AND FINANCE - EXTENDED DIPLOMA

UNIVERSITY 2nd Year

LEVELS: 5 | CREDITS: 120 | £4999

About This Course

The level 4 (diploma in accounting and finance) and level 5 (diploma in business management) are a 240 credit course designed to fast track students to the final year of an associated undergraduate degree in accounting and finance, which can either be completed at a UK university on campus or via distance learning.

The level 4 modules and assignments of this course are equivalent to the first year of a university degree. The level 5 modules and assignments are equivalent to the second year of a university degree.

This course is made up of 10 level 4 modules (120 credits) and 10 level 5 modules (120 credits); each level also includes 6 written assignments. If a student decides to only study at level 4, they will receive 120 credits and can apply for an exemption from the first year of a university degree course.

Each module consists of approximately 40 guided learning hours of material with an additional 30-50 hours of optional learning material. These materials comprise recommended exercises, recommended readings and internet resources.

Examples of University Progression

Awarding Body

Qualification

Am I eligible for this programme?

To enrol onto the level 4 course, you must be at least 18 and have a full secondary education. Before enrolling onto the level 5 course, you must have attained a level 4 or equivalent.

Course Fees

The fee for enrolling onto the level 4 and level 5 courses are £4999 each.

Students can make payment using one of the following methods:

- Credit or Debit Card

- Bank Transfer

- Interest Free Monthly installments

- Western Union

What is included in the cost of my course?

- All course material, including online modules and written assignments.

- Personal tutor support with 1-2-1 Zoom sessions where required.

- Dedicated student support

- Access to an online social learning forum

- Assignment marking and feedback.

Level: 4 Module Listing

The business environment

Explore issues outside of the business that may affect the business and its operations. Looking into economics, international dimensions, nature, and competition.

Managing and using finance

This module covers key areas of accounting, as seen from a business perspective. It explains how accountancy can inform and guide management decisions.

Maximising resources to achieve business success

An organisation that fails to dedicate sufficient attention to its use of resources will prove to be unprofitable over time. By being observant and prudent, any organisation can achieve significant gains from the management of its resources.

Quantitative skills

On successful completion of this module, learners will have knowledge of numeric exercises and will understand their use within the context of the business.

Basic accounting

On completion of this module, learners will understand accounts and how they can be used to give insight into the health of the organisation.

Budgetary control

This module aims to explain methods of financial control using budgets. This includes development and implementation of departmental budgets, which are combined to form a master budget.

Financial performance

This module aims to demonstrate how financial performance can be assessed in organisations. This includes the use of financial statements, and accounting standards. It also examines ways for raising finance over different periods of time.

Financial ratios

This module aims to demonstrate the application and meaning of the commonly used financial ratio. This includes examining liquidity, solvency, gearing and profitability.

Financial statements

This module aims to describe the preparation and presentation of the three financial statements. This includes the accounting concepts used.

Further ratios

This module aims to demonstrate how to determine financial efficiency. This includes understanding debt repayment capacity and investment appraisal. Using this knowledge, learners will be able to assess the likely of future financial success.

Level: 5 Module Listing

The entrepreneurial manager

What is an entrepreneur? Examine the skills and qualities of entrepreneurship

Organization structures

Why are organisations structured in the way they are? What determines the optimum structure and how does it differ between organisations? In this module, learners will look at the numerous models and theories that make up organisational structure.

Practical accounting analysis

Learners will complete exercises in accounts throughout this module to understand what they are telling us and the actions that analysis can precipitate.

Business planning and goal setting

What is the business trying to achieve? What will it do? How will it do it? This module focuses on the creation of clear goals and clear plans to achieve a clear objective.

Politics and business

Impact of politics on business and how it may help or hinder business. This module will educate learners on economic impact, exports and government support.

Business law

Explore the statutory responsibilities of managers as learners look into the legalities of business and business executives.

Managing in today’s world

Business in the modern world. This module focuses on governance and equality as a means to do right in business.

Performance management

Understanding how your people and your business can continually improve together, learners will review reward structures, CPD, training and development to ensure high performance in business.

Marketing and sales planning

Learners will analyse how markets, customers, competitors and products can come together in a cohesive plan.

Quantitative skills

On successful completion of this module, learners will have knowledge of numeric exercises and will understand their use within the context of the business.

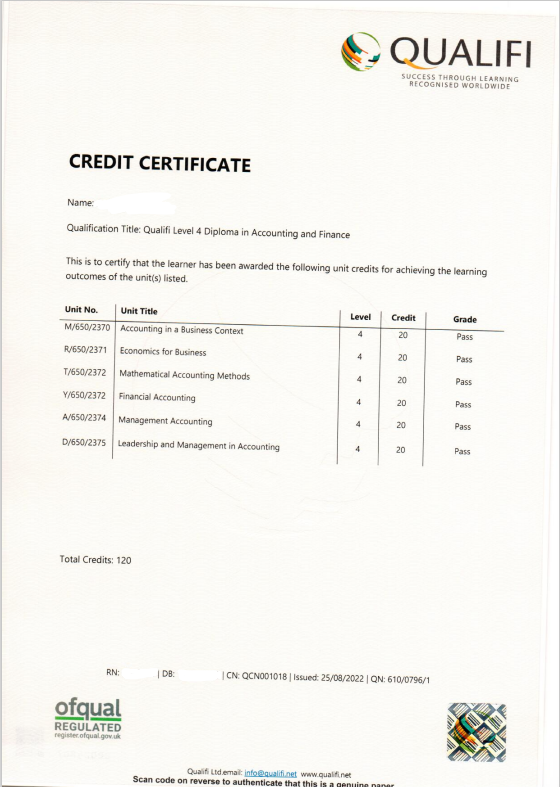

Sample Level 4 Certificate

Sample Level 5 Certificate

Written Assignments

The ATHE level 4 Diploma in Human Resource Management and the level 5 Extended Diploma in Management has 10 modules and 10 written assignments at level 4 and 8 assignments at level 5. On completion of the modules, students will be given access to the assignments. The assignments are approximately 5,000-8,000 words each. Students are provided support on the modules and assignments via the ‘Tutor’ section of the learning platform.

The assignment unit titles for the level 4 course are:

- Strategic HRM

- Managing ethically

- Culture and the organization

- Organizational structure

- Recruitment and CPD

- Working in team

- Measuring and rewarding performance

- Managing people in organizations

- Interpersonal skills

- Motivating and influencing people

The assignment unit titles for the level 5 course are:

- Managing communications

- Business organizations in a global context

- People management

- Finance for managers

- Research project

- Marketing principles and practice

- Planning a new business venture

- Business law

Assignment listing

The level 4/5 diploma in accounting and management has 10 modules and 6 written assignments at each level. The assignments are approximately 2,000-3,000 words each. Students are provided support on the modules and assignments via the ‘Tutor’ section of the learning platform.

The assignment unit titles for the level 4 course are:

- Accounting in a business context

- Economics for business mathematical

- Accounting methods

- Financial accounting

- Management accounting

- Leadership and management in accounting

- Business development

- Business models and growing organisations.

- Customer management

- Responding to the changing business environment

- Risk management and organisations

- Effective decision making

More information about the level 4 units can be found here: Qualifi Level 4 Diploma in Accounting and Finance – Qualifi

The assignment unit titles for the level 5 course are:

More information about the level 4 units can be found here: Qualifi level 5 diploma in business management

University Top-Up

If you decide to top up to a full undergraduate degree through an accredited UK university, the costs are listed below.

Anglia Ruskin University

- BA (Hons) Management – £4,850

Northampton University

- BA (Hons) in Business and Management – £5,280

- BSc (Hons) in International Accounting -£9,250

University of Derby

- Business and Management – £4,400

Westcliff University

- Business Administration – £11,655

University of Hertfordshire

- BA (Hons) Business Administration – £6,400

University of Central Lancashire (UCLAN)

- BA (Hons) Business Management – £9,240

Edinburgh Napier University

- BA in Business Management – £4,600

- BA in Business and Enterprise – £4,600

- BA in Sales Management – £4,600

University of Sunderland – On Campus

- BA (Hons) Business and Management – £9,250

University of Bolton

- BA (Hons) Top-up, fee £10,250

University of Cumbria

- BA (Hons) Global Business Management – ON CAMPUS– £9,250 UK/ £13,250 International

- BA (Hons) International Business Management – ON CAMPUS– £9,250 UK/ £13,250 International

University of Nicosia, Cyprus

- Undergraduate Top up to BA – €6,000

NOTE: UK/EU students may be eligible for student loans for the top-up portion of their studies. Visit www.slc.co.uk for more information.

Career Path

Successful completion of the undergraduate level 4 (accounting and finance) and level 5 (business management) and final year of an accredited undergraduate degree programme will give students the right credentials to go on and apply for a job in marketing, accounting, human resources, management or business consultancy.